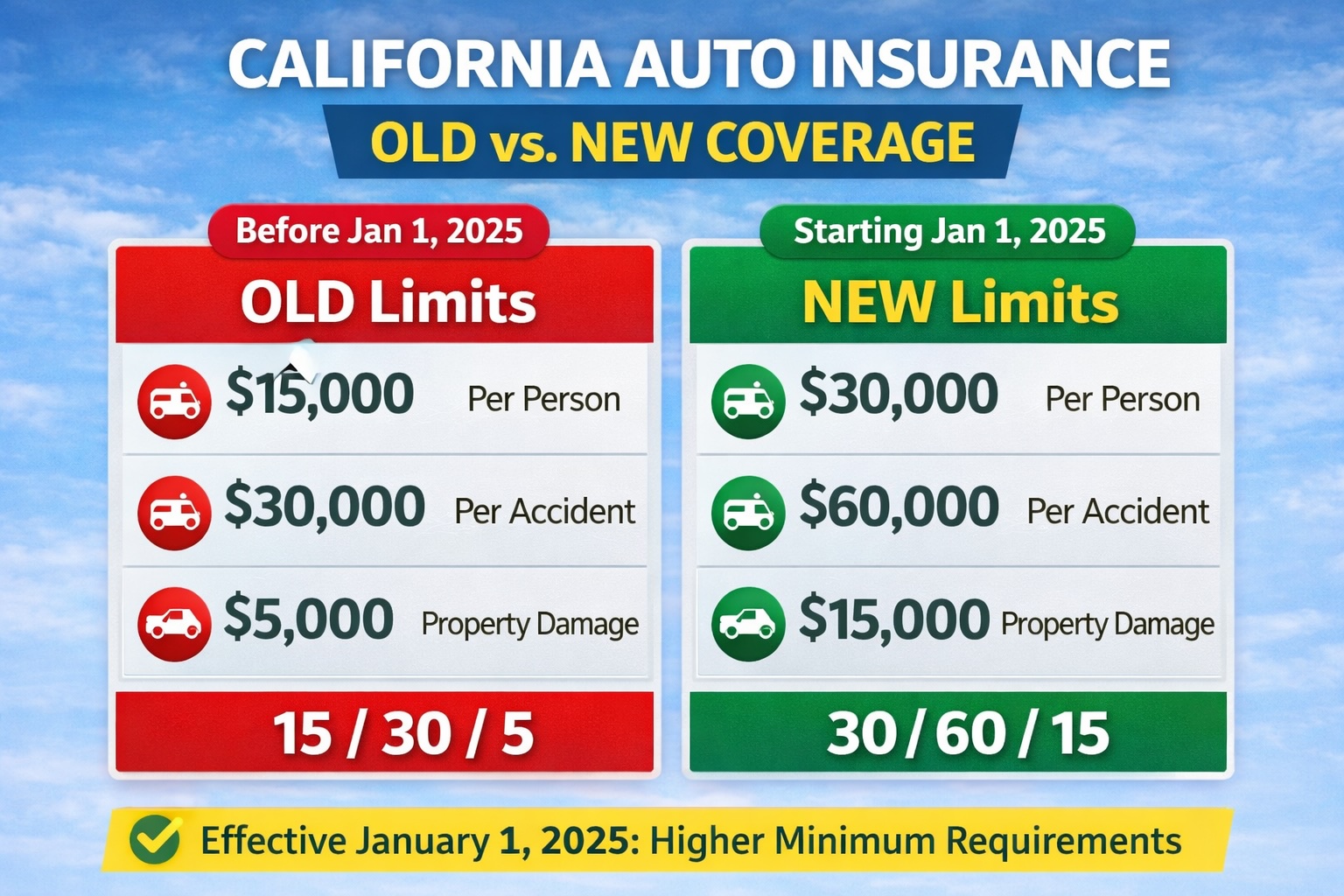

Starting January 1, 2025, California drivers will be required to carry higher auto liability insurance limits for the first time in decades. These changes are designed to better reflect today’s medical costs, vehicle repair expenses, and the financial realities of serious accidents.

If you haven’t reviewed your auto insurance coverage recently, now is the perfect time.

What Are California’s New Auto Liability Limits?

Under California law, auto liability insurance pays for injuries and property damage you cause to others in an accident. It does not cover your own vehicle or medical bills.

As of January 1, 2025, the new minimum liability limits are:

- $30,000 for bodily injury per person

- $60,000 for bodily injury per accident

- $15,000 for property damage

These limits are commonly written as 30 / 60 / 15.

This is a major increase from the previous minimum of 15 / 30 / 5, which had not changed in over 50 years.

Important: The new limits apply when your policy renews on or after January 1, 2025.

Why Minimum Coverage May Not Be Enough

While the new minimum limits are higher, they may still fall short in a serious accident.

- Emergency room visits can easily exceed $30,000

- New vehicle repairs often exceed $15,000

- Multi-vehicle accidents can quickly exceed $60,000

If damages exceed your policy limits, you are personally responsible for the remaining balance — which could put your savings, home, or wages at risk.

That’s why many drivers choose higher liability limits for added protection and peace of mind.

California Auto Liability Coverage Options (2025)

Below is a comparison of minimum and higher coverage options, so you can see what level of protection may be right for you.

Auto Liability Coverage Options

| Coverage Option | Bodily Injury Per Person / Per Accident | Property Damage | Ideal For |

|---|---|---|---|

| State Minimum | $30,000 / $60,000 | $15,000 | Legal compliance only |

| Better Coverage | $50,000 / $100,000 | $50,000 | Common customer upgrade |

| Recommended | $100,000 / $300,000 | $100,000 | Most drivers |

| High Coverage | $250,000 / $500,000 | $100,000 | Homeowners & assets |

| Very High Coverage | $500,000 / $500,000 | $250,000 | Maximum protection |

| Umbrella Policy | +$1,000,000+ | +$1,000,000+ | Extra layer above auto limits |

What Coverage Is Right for You?

- Minimum coverage may meet legal requirements, but offers limited protection

- $100 / 300 / 100 is widely recommended for most drivers

- Higher limits or umbrella policies are ideal for homeowners, families, and anyone with assets to protect

Every driver’s situation is different. The right coverage depends on your income, assets, and risk tolerance.

Need Help Choosing the Right Coverage?

At Yessenia’s Insurance Services, we help drivers understand their options and choose coverage that fits their needs — not just the minimum required by law.

📞 Contact us today to review your policy before your next renewal and make sure you’re properly protected.