Americans have received conflicting information on when they will receive stimulus checks due to the economic fallout from the coronavirus pandemic. But there’s good news: Checks will be hitting their bank accounts soon.

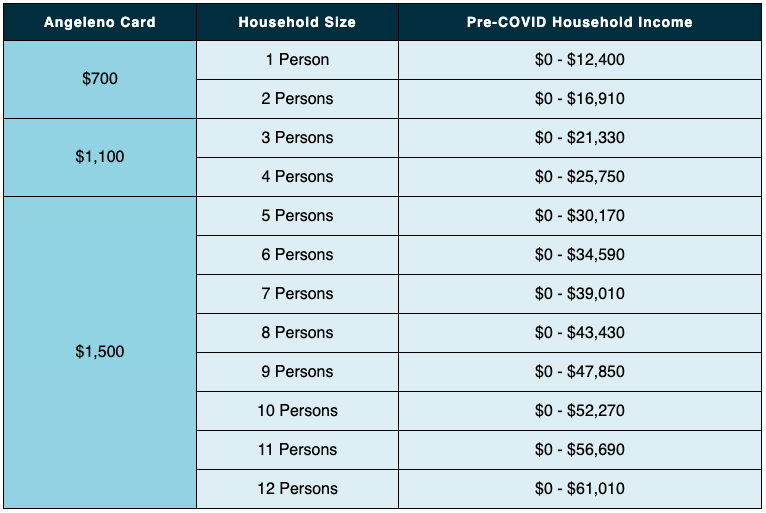

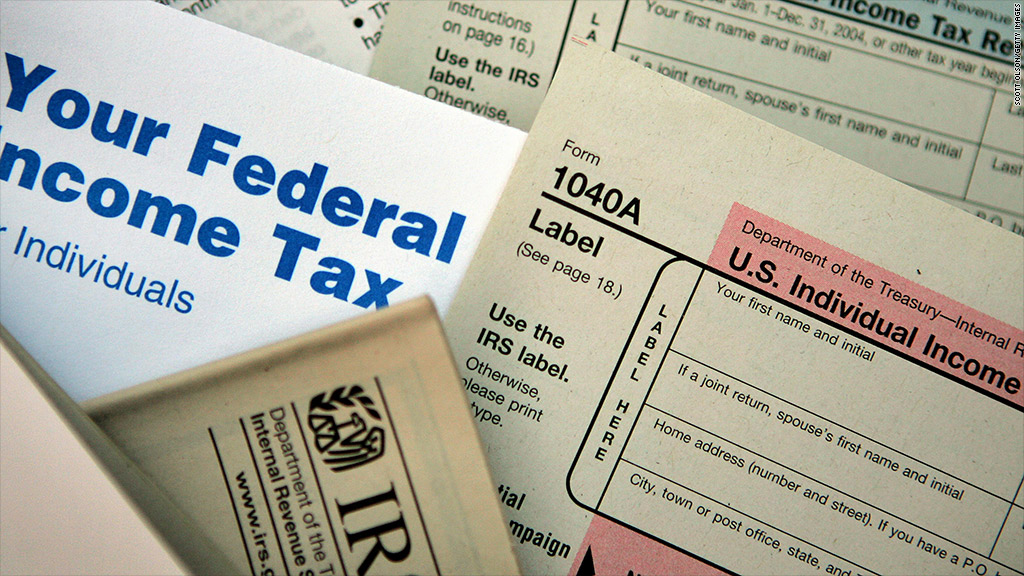

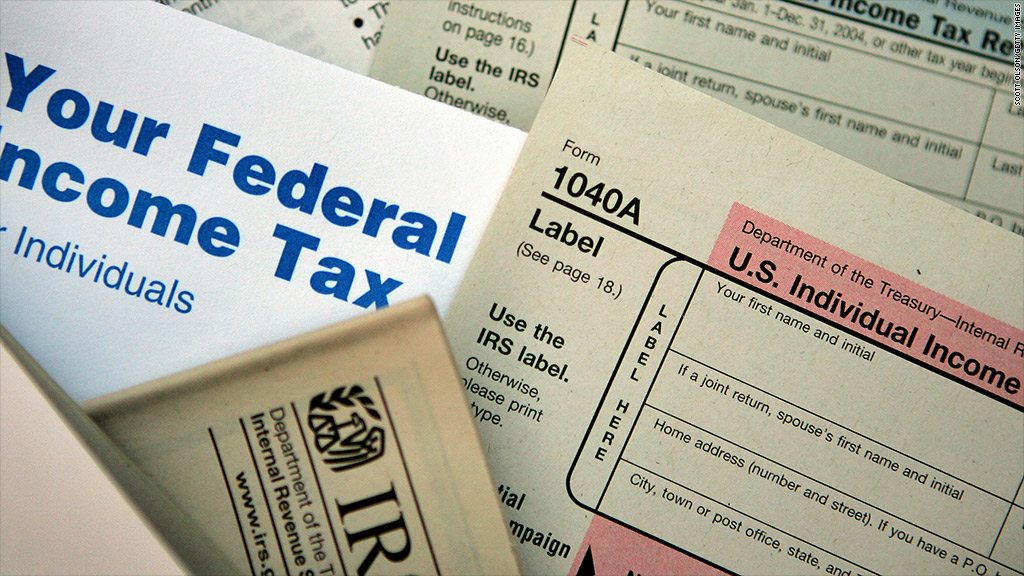

Automatic payments are set to begin next week. Eligible taxpayers who filed tax returns for either 2019 or 2018 and chose direct deposit for their refund will automatically receive a stimulus payment of up to $1,200 for individuals or $2,400 for married couples and $500 for each qualifying child, the IRS said Friday.

What if I did not file a return in 2018 or 2019 ?

The non-filer tool provides a free option designed for people who don’t normally file a tax return, including those with too little income to file. The IRS said stimulus payments will be distributed to most Americans starting next week.

Here is the link

https://www.irs.gov/coronavirus/non-filers-enter-payment-info-here

Who is eligible for the Economic Impact Payment?

U.S. citizens or resident aliens who:

- Have a valid Social Security number,

- Could not be claimed as a dependent of another taxpayer, and

- Had adjusted gross income under certain limits.